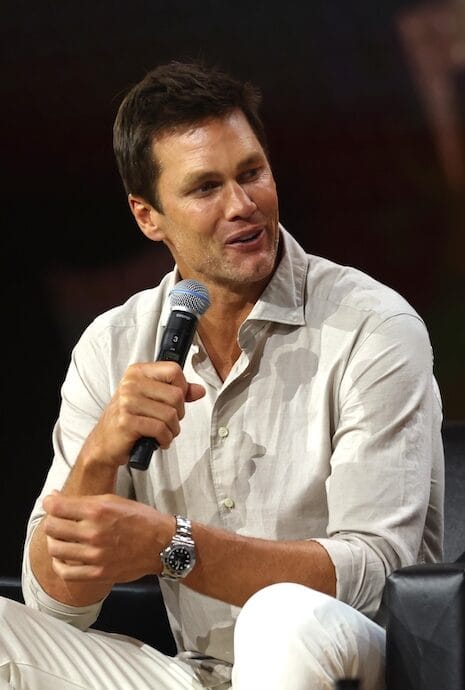

TOM BRADY IS WATCHING HIS TAX DOLLARS

Tom Brady is adding to his real estate portfolio- for a good reason. The former star quarterback turned sportscaster already owns mansions in Miami, and Brentwood, California, as well as an apartment in Manhattan, but now he’s heading to Sin City. Tom spent a few days in mid June touring properties in Vegas, specifically in Continue reading “TOM BRADY IS WATCHING HIS TAX DOLLARS”